Why should I choose AnalystNotes?

AnalystNotes specializes in helping candidates pass. Period.

Basic Question 0 of 2

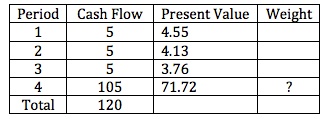

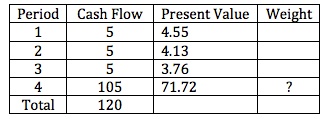

Consider a four-year, 5% annual coupon payment bond. Its yield to maturity is 10% and its price is 84.16 per 100 of par value.

B. 0.7172

C. 0.8522

To calculate Macaulay duration, what should be the weight of the last payment of 105?

A. 0.8750

B. 0.7172

C. 0.8522

User Contributed Comments 1

| User | Comment |

|---|---|

| janglejuic | 71.72 / (4.55+4.13+3.76+71.72) |

I am using your study notes and I know of at least 5 other friends of mine who used it and passed the exam last Dec. Keep up your great work!

Barnes

Learning Outcome Statements

describe the relationships among a bond's holding period return, its Macaulay duration, and the investment horizon

define, calculate, and interpret Macaulay duration

CFA® 2025 Level I Curriculum, Volume 4, Module 10.