- CFA Exams

- 2026 Level I

- Topic 9. Portfolio Management

- Learning Module 1. Portfolio Risk and Return: Part I

- Subject 3. Application of Utility Theory to Portfolio Selection

Why should I choose AnalystNotes?

Simply put: AnalystNotes offers the best value and the best product available to help you pass your exams.

Subject 3. Application of Utility Theory to Portfolio Selection PDF Download

The Capital Allocation Line

Suppose we construct a portfolio (P) that combines a risky asset i with an expected return of ri and standard deviation of σi, and a riskless asset with a return of rf. Let w1 represent the fraction of the total portfolio value placed in the riskless asset.

- The portfolio return E(rp) is given by E(rp) = w1 rf + (1 - w1) E(ri).

- The portfolio standard deviation is given by σp = (1 - w1) σi

Example

Combine the S&P and a T-bill in a portfolio. E(rS&P) = 13%, σS&P = 20.3%, and rf = 3.8%. Some of the possible portfolios are:

- w1 = 0, E(rp) = E(rS&P) = 13%, and σp = 20.3%.

- w1 = 0.5, E(rp) = 0.5 x 0.038 + 0.5 x 0.13 = 8.4%, and σp = 0.5 x 20.3% = 10.1%.

- w1 = 1, E(rp) = rf) = 3.8%, and σp = 0%.

- w1 = -0.5, E(rp) = -0.5 x 0.038 + 1.5 x 0.13 = 17.6%, and σp = 1.5 x 0.203 = 30.5%. This means there is negative investment in the riskfree asset: the investor borrowed at the risk-free rate. This is called a leveraged position in the risky asset - some of the investment is financed by borrowing.

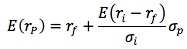

The portfolio's expected return and standard deviation obey a liner relation:

- The slope, [(E(ri - rf)/σi], is known as the portfolio's Sharpe measure or reward-to-variability ratio.

- The intercept is the risk-free rate.

- The line is called the capital allocation line (CAL). When i is a marker index portfolio, the line is called the capital market line (CML).

- A leveraged position is to the right of P.

CAL shows one simple fact: increasing the amount invested in the risky asset increases the expected return by a certain risk premium.

Now the investor must find the point of highest utility on CAL.

The optimal choice for an investor is the point of tangency of the highest indifference curve to the CAL - slope of the indifference curve is equal to the slope of the CAL.

The optimal w1 will be higher for investors with higher A.

User Contributed Comments 0

You need to log in first to add your comment.

I passed! I did not get a chance to tell you before the exam - but your site was excellent. I will definitely take it next year for Level II.

Tamara Schultz

My Own Flashcard

No flashcard found. Add a private flashcard for the subject.

Add