- CFA Exams

- 2026 Level II

- Topic 9. Portfolio Management

- Learning Module 37. Economics and Investment Markets

- Subject 4. Credit Premiums and the Business Cycle

Why should I choose AnalystNotes?

AnalystNotes specializes in helping candidates pass. Period.

Subject 4. Credit Premiums and the Business Cycle PDF Download

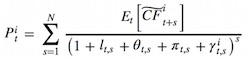

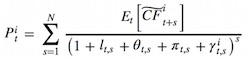

We now add the credit risk to the basic pricing equation for corporate bonds.

expected loss = probability of default x (1 - recovery rate)

γit,s represents the credit premium demanded by investors.

There is uncertainty about the cash flows in the above equation.

During a recession the probability of default will rise and the recovery rate will be lower, causing a higher loss rate.

Both government and corporate bonds are subject to interest rate risk. However, corporate bonds also embody credit risk. The credit spread is the difference between the yield on a corporate bond and that on a government bond with the same currency denomination and maturity.

The business cycle has a profound effect on credit spreads.

- Credit spread tends to rise in times of economic weakness, as the probability of default rises.

- Credit spread tends to narrow in times of robust economic growth, when defaults are less common.

Credit spreads are not constant. They will evolve with the business cycle because spreads with different ratings very often have different sensitivities to the business cycle. For example, when credit spreads are narrowing, the rate of improvement will tend to be greater for lower-rated corporate bonds. At these times investors seem to be less concerned about credit risks.

The converse is true. Credit risky bonds tend to perform poorly in bad economic times. That's why investors demand a credit premium. Specifically, the credit risk premium demanded by investors tends to rise in times of economic weakness, when the probability of a corporate default and bankruptcy is highest.

Industrial sector also affects a corporate bond's credit spread. The sensitivity of a corporate bond's spread to changes in the business cycle and the level of cyclicality tend to be positively correlated. For example, companies in the consumer cyclical sector are more sensitive to the business cycle than companies in the non-cyclical sector, and credit spreads of their bonds tend to widen more in bad economic times.

When spreads widen, the spreads on bonds issued by corporations with a low credit rating will tend to widen most.

User Contributed Comments 0

You need to log in first to add your comment.

You have a wonderful website and definitely should take some credit for your members' outstanding grades.

Colin Sampaleanu

My Own Flashcard

No flashcard found. Add a private flashcard for the subject.

Add