- CFA Exams

- 2026 Level II

- Topic 6. Fixed Income

- Learning Module 29. Credit Analysis Models

- Subject 2. Credit Scores and Credit Ratings

Seeing is believing!

Before you order, simply sign up for a free user account and in seconds you'll be experiencing the best in CFA exam preparation.

Subject 2. Credit Scores and Credit Ratings PDF Download

A credit score is used to rank a retail borrower's credit riskiness.

- Credit scoring methodologies can vary among countries.

- Credit scoring agencies are national in scope.

- Credit scores provide an ordinal ranking, not a cardinal ranking, of a borrower's credit risk. They are not percentile rankings of the borrower among a universe of borrowers.

- Credit scores have different implications depending on the borrower and the nature of the loan.

For example, five primary factors are used to calculate the FICO score, the most popular one in the U.S. They include payment history, debt burden, length of credit history, type of credit used, and recent searches for credit.

A credit rating is used to rank the credit risk of a company, government, or asset-backed security. Again, it is an ordinal ranking.

Notching: the practice by rating agencies to give different credit ratings to obligations of an issuer.

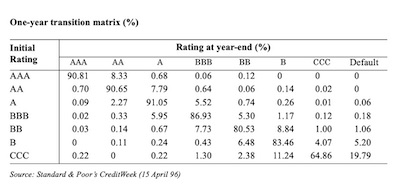

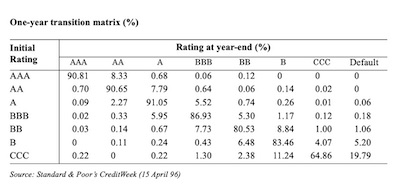

Credit Transition Matrix

Credit ratings and credit matrix of probabilities can be used to adjust a bond's yield-to-maturity to reflect the probabilities of credit migration. Credit spread migration typically reduces expected return.

The matrix gives the probabilities of rating changes over a period of, e.g., one year.

Note:

- Each row sums to 100% because a bond has to end the year in one of the eight column categories.

- The largest probabilities are on the diagonal, indicating that most ratings do not change in the course of a year.

- Some probabilities are 0 - this indicates, for example, that the change of a AAA-rated bond defaulting within one year is negligible.

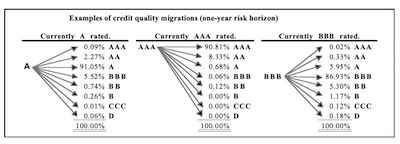

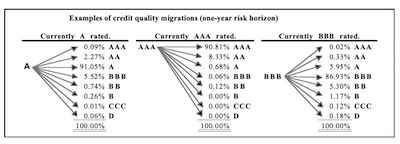

The figure further illustrates the interpretation of each row of the transition matrix.

To calculate the expected return on a bond given transition in its credit rating:

- For each possible transition, calculate the expected percentage price change as the product of the modified duration and the change in the spread.

- Get the exepected value: it is the sum of (expected price change x respective transition probability)

User Contributed Comments 0

You need to log in first to add your comment.

I am using your study notes and I know of at least 5 other friends of mine who used it and passed the exam last Dec. Keep up your great work!

Barnes

My Own Flashcard

No flashcard found. Add a private flashcard for the subject.

Add