- CFA Exams

- 2026 Level I

- Topic 4. Financial Statement Analysis

- Learning Module 2. Analyzing Income Statements

- Subject 5. Earnings per Share

Why should I choose AnalystNotes?

AnalystNotes specializes in helping candidates pass. Period.

Subject 5. Earnings per Share PDF Download

Earnings per share (EPS) is a measure that is widely used to evaluate the profitability of a company.

A company's capital structure is simple if it consists of only common stock or includes no potential common stock that upon conversion or exercise could dilute earnings per common share. Companies with simple capital structures only need to report basic EPS.

A complex capital structure contains securities that could have a dilutive effect on earnings per common share. Dilutive securities are securities that, upon conversion or exercise, could dilute earnings per share. These securities include options, warrants, convertible bonds, and preferred stocks.

Companies with complex capital structures must report both basic EPS and diluted EPS. Calculation of diluted EPS under a complex capital structure allows investors to see the adverse impact on EPS if all diluted securities are converted into common stock.

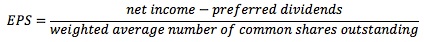

Basic EPS

To calculate EPS in a simple capital structure:

The current year's preferred dividends are subtracted from net income because EPS refers to earnings available to the common shareholder. Common stock dividends are not subtracted from net income.

Since the number of common shares outstanding may change over the year, the weighted average is used to compute EPS. The weighted average number of common shares is the number of shares outstanding during the year weighted by the portion of the year they were outstanding. Analysts need to find the equivalent number of whole shares outstanding for the year.

Three steps are used to compute the weighted average number of common shares outstanding:

- Identify the beginning balance of common shares and changes in the common shares during the year.

- For each change in the common shares:

- Compute the number of shares outstanding after each change in the common shares. Issuance of new shares increases the number of shares outstanding. Repurchase of shares reduces the number of shares outstanding.

- Weight the shares outstanding by the portion of the year between this change and next change: weight = days outstanding / 365 = months outstanding / 12

- Sum up to compute the weighted average number of common shares outstanding.

Stock Dividends and Splits

In computing the weighted average number of shares, stock dividends and stock splits are only changes in the units of measurement, not changes in the ownership of earnings. A stock dividend or split does not change the shareholders' total investment (i.e., it means more pieces of paper for shareholders).

When a stock dividend or split occurs, computation of the weighted average number of shares requires restatement of the shares outstanding before the stock dividend or split. It is not weighted by the portion of the year after the stock dividend or split occurred.

Specifically, before starting the three steps of computing the weighted average, the following numbers should be restated to reflect the effects of the stock dividend/split:

- The beginning balance of shares outstanding;

- All share issuance or purchase prior to the stock dividend or split.

- No restatement should be made for shares issued or purchased after the date of the stock dividend or split.

If a stock dividend or split occurs after the end of the year but before the financial statements are issued, the weighted average number of shares outstanding for the year (and any other years presented in comparative form) must be restated.

Example

1. 01/01/15 - 100,000 shares issued and outstanding at the beginning of the year

2. 07/01/15 - 10% stock dividend

3. 09/01/15 - 3 for 1 stock split

4. 10/01/15 - 50,000 shared issued

The weighted average number of shares is:

100,000 x 1.1 x 3 x 9/12 + (100,000 x 1.1 x 3 + 50,000) x 3 / 12 = 342,500

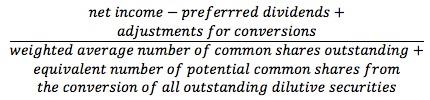

Diluted EPS

If a company has a complex capital structure, it must report two EPS figures: basic EPS and diluted EPS.

The securities could be either dilutive or antidilutive. Antidilutive securities are those that, upon conversion or exercise, increase earnings per share or reduce loss per share. The likelihood of conversion or exercise of antidilutive securities is considered remote.

Diluted EPS shows the maximum potential adverse effect on EPS if dilutive securities are converted to common stock. The purpose is to show the "worst case" scenario. Therefore, the computation of diluted EPS does not consider antidilutive securities, which increase EPS. In computing diluted EPS, analysts need to check each potentially dilutive security individually to see whether it is dilutive or antidilutive. All antidilutive securities should be excluded and cannot be used to offset dilutive securities.

Only income from continuing operations (excluding discontinued operations, extraordinary items, and accounting changes) is considered in determining diluted EPS.

To compute diluted EPS, start from basic EPS and remove the adverse effect of all dilutive securities outstanding during the period. In computing diluted EPS, the adverse effects of dilutive securities are removed by adjusting the numerator and the denominator of the basic EPS formula.

- Identify all potentially dilutive securities: convertible bonds, options, convertible preferred stock, warrants, etc.

- Compute the basic EPS. The effect of potentially dilutive securities is not included in the computation.

- Determine the effect of each potentially dilutive security on EPS to see whether it is dilutive or antidilutive. How? Compute the adjusted EPS assuming the conversion occurs. If adjusted EPS < (>) basic EPS, the security is dilutive (antidilutive).

- Exclude all antidilutive securities from the computation of diluted EPS.

- Use basic and dilutive securities to compute diluted EPS.

If-Converted Method - Convertible Securities

If a company has a complex capital structure containing convertible bonds and preferred stocks, then diluted EPS will treat these securities as if they were converted to common stocks from the first of the year (or when issued, if issued during the current year).

The effect of a convertible bond on EPS:

Upon conversion, the numerator (net income) of the basic EPS formula will be increased by the amount of interest expense, net of tax associated with those potential common shares. Why? If converted, there would be no interest for the bond, so income available to common shares will increase accordingly. After-tax interest is used because bond interest is tax deductible while net income is computed on an after-tax basis.

Upon conversion, the denominator (weighted average number of shares outstanding) of the basic EPS formula will be increased by the number of shares created from the conversion, weighted by the time that these shares would be outstanding: number of shares due to conversion = par value of the convertible bond / conversion price

The time outstanding would be the entire year if the bond was issued in a previous year, or a fraction of the year if the bond is issued in the current year.

The effect of a convertible preferred stock on EPS:

Upon conversion, the numerator of the basic EPS formula would increase by the amount of the preferred dividends. If converted, there would be no dividends for the convertible preferred stock so income available to common shares would increase accordingly. Unlike bond interests, preferred dividends are not tax-deductible.

Upon conversion, the denominator of the basic EPS formula would increase by the number of shares created from the conversion weighted by the time that these shares would be outstanding: number of shares due to conversion = number of convertible preferred shares outstanding x conversion rate.

The time outstanding would be the entire year, if the preferred stock was issued in a previous year, or a fraction of the year, if the preferred stock is issued in the current year.

Treasury Stock Method - Options and Warrants

This method assumes that options and warrants are exercised at the beginning of the year (or date of issue if later) and the proceeds from the exercise of options and warrants are used to purchase common stock for the treasury. There is no adjustment to net income in the numerator.

Upon exercise of the options or warrants, the company receives the following amount of proceeds: exercise price of the option x number of shares issued to holders of the options or warrants.

The company will then use the proceeds from the exercise of options and warrants to buy back common shares at the average market price for the year.

The net change in the number of shares outstanding is the number of shares issued to holders of the options or warrants less the number of shares acquired from the market.

If the exercise price of the option or warrants is lower than the market price of the stock, dilution occurs. If it is higher, the number of common shares is reduced and an antidilutive effect occurs. In the latter case, exercise is not assumed.

Like the if-converted method, the treasury stock method makes the following assumptions:

- If an option or warrant was issued in a previous year, it is assumed to be exercised at the beginning of the current year. Thus, the net change in common shares is outstanding for the entire year.

- If the option or warrant is issued during the current year, its exercise occurs at the date of issuance. Thus, the net change in common shares is outstanding for a fraction of the current year, starting from the date of issuance.

Note: If there are restrictions on the proceeds received when warrants are exercised, dilutive EPS calculations must reflect the results of those agreements.

User Contributed Comments 23

| User | Comment |

|---|---|

| kalps | Treasury stock method does not adjust net income in numerator. It assumes that the proceeds are used to repurchase stock (and there is dilution f exerecise price is lower than the market value) |

| kalps | Increase numerator by interest expense becos of assumption of conversion and therefore should be reversed |

| sarath | Diluted EPS is the worst case scenario. |

| Nikita | When calculating Basic EPS do you include preferred stock |

| o123 | * the treasury method assumption; that proceeds from options will be used to buy back common shares is just that - an assumption. ...its just a way to show the anti-dilutive effect of options if the x price is greater than mkt price. ...I'm not sure about this, but its how I'm viewing it...? ideas anyone? |

| epizi | You are right but a little correction in your point,If X price is less than the Stock price. It is more like a call option where Max(0;S-X).The firm is the seller of a call, and the buyers are the public. Assume now that S-X>0 then exercise, and the firm will have to sell the stock of make cash settlement. This cash settlement reduces the net income and hence EPS. |

| rethan | The notes states the following with regard to options: "If the EXCERCISE PRICE of the option or warrants is lower than the MARKET PRICE price of the stock, dilution occurs". This does not make sense to me. Here is an example, a CEO has an option to buy 1000 shares of his company's stock @ $ 25 a chare. The currest market price of the company's stock is $ 50. He excercises his option. Here is what will happen as a result: "Upon exercise of the options or warrants, the company receives the following amount of proceeds: exercise price of the option x number of shares issued to holders of the options or warrants" Thus, the company will get $ 25,000($ 25(strike price) X 1000 (shares) Now according to the notes, "The company will then use the proceeds from the exercise of options and warrants to buy back common shares at the average market price for the year" So using the $ 25,000 in proceeds the company will buy from the market the following number of shares: 500 ($ 25,000/ $ 50 (Proceeds/market price) HOW WILL THIS LEAD TO DILUTION? The number of shares floating has been reduced by 500 as 500 shares have been taken out of circulation and now are treasury stock. Won't this be antidilutive as it will increase EPS?? Can someone explain? |

| charlie1 | rethan: that's dilution. The company issues 500 new shares and buys back 500 existing shares to give it to the CEO. The result? 500 more shares due to the transactions. |

| pavlomel | The company issues 1000 new shares to the CEO, and buys back only 500, the net effect is 500 more shares on the market. |

| SriSri | Can anyone explains the example calculation above please. 100,000 x 1.1 x 3 x 9/12 + (100,000 x 1.1 x 3 + 50,000) x 3 / 12 = 342,500 |

| lpan | I think the answer for the example above is slightly confusing.. the first part..100,000 x 1.1 x 3 x 9/12 assumes the stock split and the div was paid in Jan..but that the additional shares issued was in oct. Correct me if I'm wrong but going by the dates the answer should be: 100,000 x 6/12 + 100,000 x 1.1 x 2/12+ 100,000 x 1.1x 3 x 1/12+ (100,000 x 1.1 x 3 + 50,000) x 3/12 |

| rm001 | Don't the CFA notes say that in case of stock split, the calculation for weighted average is to be taken for full year i.e if stock splits into 2 on the last day, then there are effectively 2 times the stock available for the denominator. Please correct me here !! |

| Lucas24 | Can some1 please put the above example in simple form pleaseeeeeeeeee |

| dexterity | Please Note : (i) Splits and dividends are applied to all shares issued prior to the split and hence should be adjusted accordingly (ii)Shares that are re purchased or issued after stock split and dividends should not be adjusted. So, after adjusting the stock split and dividents now the number of shares outstanding becomes=100000x1.1x3 which is on 01/01 and 50000 shares added which is on 10/01. Now you can use your regular method to calculate wt. Avg. |

| jpducros | At SriSri, honestly I find the following simpler : 100,000 * 1,1 * 3 + 50,000 * 3/12 = 342,500. |

| Mgtw | Why don't the stock dividend and split apply to the '50,000' shares? |

| erinelize | Because the dividend and split happened before the 50,000 shares were issued and therefor only affected the original 100,000 shares. |

| cleopatraliao | Read the book first then look back at the notes and do the questions make much more sense :D VICTORY!! |

| LONG | Just remember that the purpose of stock dividend and the stock split are two ways of the same thing. So I can share my method to calculate Weighted Average of Shares is: Jan. 2002 Initial shares adjusted for 10% of stock dividend is 100,000x(1.1) and then adjusted for 3 for 1 stock split it become 100,000x(1.1)x3=330,000 Jan. 2002 ===> 330,000x12 = 3,960,000 (12 months) Oct. 2002 ===> 50,000x3 = 150,000 (3 months) ================================================= Avg. (3,960,000 + 150,000)/12 = 342,500 shares |

| msoentoro | The notes said that "only income from continuing operation (excluding discontinued operation, extraordinary items, etc) is considered in determining diluted EPS", then why we still use Net Income in diluted EPS formula? |

| hiyujie | Diluted EPS is never a worst case scenario, and it's very common if you look at the company's earning report. It almost always report simple and diluted EPS side by side. |

| TheProfet | The example for computing WACSO (where the answer is 342,500) is incorrect. The stock dividend doesn't result in a retroactive increase in shares back to 1/1/2002. The 10% increase only goes from July forward. The correct answer is 100,000 * 3 * (6/12) + 110,000 * 3 * (2/12) + 330,000 * 1 * (1/12) + 380,000 * 1 * (3/12) = 327,500 |

| TheProfet | I checked. I was incorrect. The answer above is correct. Stock dividends, upon declaration, are applied retroactively to the shares outstanding prior to such declaration. |

I just wanted to share the good news that I passed CFA Level I!!! Thank you for your help - I think the online question bank helped cut the clutter and made a positive difference.

Edward Liu

My Own Flashcard

No flashcard found. Add a private flashcard for the subject.

Add