- CFA Exams

- 2026 Level I

- Topic 2. Economics

- Learning Module 6. International Trade

- Subject 2. International Trade Restrictions and Agreements

Why should I choose AnalystNotes?

AnalystNotes specializes in helping candidates pass. Period.

Subject 2. International Trade Restrictions and Agreements PDF Download

Governments restrict international trade to protect domestic producers from competition by using many trade policies. All trade restriction policies result in higher prices and higher domestic production (more producer surplus) but lower domestic consumption (less consumer surplus).

For purposes of international trade policy and analysis:

- A small country cannot affect the world price of traded goods. In a small country, trade barriers always generate a net welfare loss arising from distortion of production and consumption decisions and the associated inefficient allocation of resources.

- A large country's production and/or consumption decisions do alter the relative prices of traded goods. Trade barriers can generate a net welfare gain in a large country if it imposes an even larger welfare loss on its trading partners.

Tariffs

A tariff is a tax levied on goods imported into a country. It benefits domestic producers and the government at the expense of consumers.

Let's illustrate the impact of a tariff on automobiles. Without a tariff, the world market price (Pw) would prevail in the domestic market. U.S. consumers purchase Q1 units while U.S. producers supply Qd1 units. When the U.S. imposes a tariff (t) on imports of automobiles, U.S. consumers now pay (Pw + t) to purchase automobiles from foreigners. Due to the higher price, U.S. consumers will reduce demand from Q1 to Q2, while U.S. producers will increase supply from Qd1 to Qd2. Imports from foreigners will reduce from Q2 to Qd2.

The tariff benefits domestic producers and the government. It protects domestic producers from foreign competition. Consequently, domestic producers can supply goods at a higher price. Domestic producers gain the area S in the form of additional revenue. The government gains the area T in the form of tax revenues collected on imports.

The tariff harms domestic consumers as they have to pay a higher price for fewer goods. They lose the area S + U + T + V. Note that areas U and V are a deadweight loss (loss of efficiency) for the economy since they do not benefit either producers or the government.

In effect, a tarrif acts as a subsidy to domestic producers. Potential gains from specialization and trade go unrealized.

Quotas

An import quota is a specific limit or maximum quantity (or value) of a good permitted to be imported into a country during a given period. It is designed to restrict foreign goods and protect domestic industries.

Assume that a quota limits imports of automobiles to (Q2 - Qd2), a quantity below the free trade level of imports (Q1 - Qd1). Since the quota reduces foreign supply, domestic price will be pushed up to P2. Due to the higher price, U.S. consumers will reduce demand from Q1 to Q2, while U.S. producers will increase supply from Qd1 to Qd2. Like a tariff, an import quota benefits domestic producers but harms domestic consumers.

However, different from a tariff, an import quota benefits foreign producers at the expense of the government; with a quota, foreign producers who are granted permission to sell in the domestic market can charge premium prices for the limited supply of foreign goods. The area T represents the gains of those foreign producers. Under a tariff, the government would gain the area T in the form of tariff revenues. This politically granted privilege creates a strong incentive for foreign producers to engage in rent-seeking activities. In addition, with a quota foreign producers are prohibited from selling additional units regardless of how much lower their costs are relative to those of domestic producers. Therefore, quotas are more harmful than tariffs in many ways.

A voluntary export restraint (VER) is an agreement between two governments in which the government of the exporting country agrees to restrain the volume of its own exports. Foreign firms and governments will sometimes agree to limit their exports to a country to avoid the imposition of other types of trade barriers. The economic impact of a VER is similar to that of a quota. The main difference:

- A quota is imposed by the importer.

- A VER is imposed by the exporter.

Export Subsidies

An export subsidy is a government policy to encourage export of goods and discourage sale of goods in the domestic market. The subsidy ends up costing the government instead of generating revenue. Also, unlike an import tariff, an export subsidy increases the amounts traded.

The distortion of production, consumption, and trade decisions generates a welfare loss. This welfare loss is greater for a large country because increased production and export of the subsidized product reduces its global price - that is, it worsens the country's terms of trade.

Example 1

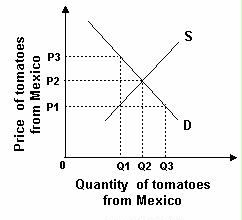

Refer to the graph below. What tariff would the government have to impose on tomatoes imported from Mexico to have the same effect as a quota of Q1?

A tariff that shifts supply to where it intersects demand at P3 and Q1 would be the equivalent of a quota of Q1. This would happen with a tariff of P3-P1.

Example 2

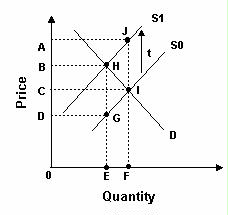

Refer to the graph below. If this graph represents the supply of and demand for an imported product, a tariff of t will result in revenue for the government, shown by area ______.

A tariff of t shifts the supply curve up from S0 to S1. Quantity sold is now OE. Tariff revenue is t times quantity OE, shown by the rectangle BDGH.

Example 3

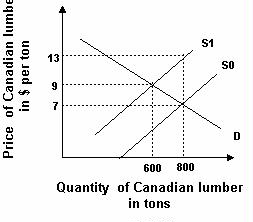

Refer to the graph below. With a quota of 600 tons on lumber imported from Canada, the revenue the government would collect from the import of lumber would be:

Answer: The government does not collect revenue with a quota.

Example 4

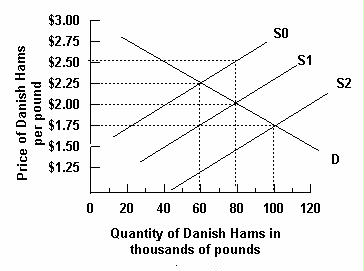

Refer to the graph below. Demand and supply are initially D and S1, respectively. Which of the following best describes the effect of a $.50 per pound tariff on Danish hams imported into the United States?

Answer: A tariff shifts the supply curve to the left by the amount of the tax. Equilibrium price is determined where quantity demanded equals quantity supplied, at $2.25 per pound and 60 thousand pounds.

User Contributed Comments 3

| User | Comment |

|---|---|

| jmorris | I did not get the answer for Example 4. So, the price goes up to 2.50 as shown on S0. After that, why does it fall down to 2.25 at quantity 60? Shouldn't the supply be around 40 at a rate of 2.50 as per the graph? |

| doudou | @guest: at price = 2.5, demand will not be kept at 80. it will be 40. Supply and demand will both change and meet at price = 2.25 and quantity = 60. |

| Freddie33 | F*** that must be the longest section I've done so fa |

You have a wonderful website and definitely should take some credit for your members' outstanding grades.

Colin Sampaleanu

My Own Flashcard

No flashcard found. Add a private flashcard for the subject.

Add