- CFA Exams

- 2026 Level I

- Topic 4. Financial Statement Analysis

- Learning Module 11. Financial Analysis Techniques

- Subject 3. Liquidity Ratios

Seeing is believing!

Before you order, simply sign up for a free user account and in seconds you'll be experiencing the best in CFA exam preparation.

Subject 3. Liquidity Ratios PDF Download

Liquidity ratios measure the ability of a company to meet short-term obligations. Major liquidity ratios such as current ratio, quick ratio, and cash ratio are discussed in Topic [Analyzing Balance Sheets].

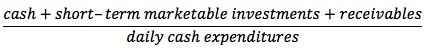

The defensive interval ratio measures how long a company can pay its daily cash expenditures using only its existing liquid assets, without additional cash flow coming in. It provides an intuitive "feel" for a company's liquidity, albeit a most conservative one. It compares currently available "quick" sources of cash with the estimated outflows needed to operate the company: projected expenditures.

This ratio represents a "worst case" scenario, indicating the number of days a company could maintain its current level of operations with its present cash resources but without considering any additional revenues.

The cash conversion cycle is the time period that exists from when the company pays out money for the purchase of raw materials to when it gets the money back from the purchasers of the company's finished goods. In short, it measures the number of days the company's cash is tied up in the business. When the company buys raw materials, it commits capital to inventory. At the same time, suppliers provide interest-free loans to the company by carrying its payables, thus offsetting the company's capital commitment. After the products are sold, the capital is then tied up in receivables for the collection period. The cash conversion cycle is a measure of how fast a dollar spent returns to the company in payment for a sale. A very high cash conversion cycle indicates that too much capital is tied up in the sales process.Cash Conversion Cycle = DOH + DSO - Number of Days of Payables

Note: Analysts should be aware of the impact of accounting choices and accounting transactions on liquidity ratios. For example, payment of an accounts receivable has no effect since one current asset is increasing and another is decreasing. Capitalizing a lease decreases the current ratio, since capitalizing a lease puts a liability on the balance sheet and the portion due in the next year is classified as a current liability. An increase in the turnover ratio decreases the number of days for collection of a receivable or sale of inventory and hence shortens the cash conversion cycle. Use of LIFO versus FIFO in periods of rising prices results in a lower inventory balance and hence a lower current ratio.

User Contributed Comments 0

You need to log in first to add your comment.

I just wanted to share the good news that I passed CFA Level I!!! Thank you for your help - I think the online question bank helped cut the clutter and made a positive difference.

Edward Liu

My Own Flashcard

No flashcard found. Add a private flashcard for the subject.

Add