- CFA Exams

- 2026 Level I

- Topic 8. Alternative Investments

- Learning Module 4. Real Estate and Infrastructure

- Subject 2. Real Estate Investment Characteristics

Why should I choose AnalystNotes?

AnalystNotes specializes in helping candidates pass. Period.

Subject 2. Real Estate Investment Characteristics PDF Download

The return comes from income or asset appreciation or a combination of both. More than half of the returns commercial real estate investors earn are derived from income, and throughout an economic market cycle, real estate income is a more consistent source of return than capital appreciation.

Investing in real estate can generate either lower-risk, bond-like cash flows from leases or higher-risk equity-like speculative returns from realizing value from development projects or price appreciation.

Real estate investing can be lucrative, but it's important to understand the risks. Key risks include bad locations, negative cash flow, high vacancies, and problem tenants. Other risks to consider are the lack of liquidity, hidden structural problems, and the unpredictable nature of the real estate market. Leverage also magnifies the effects of both gains and losses for both equity and debt investors.

Diversification Benefits

Due to real estate's moderate correlation with other asset classes, it has been demonstrated to reduce portfolio risk. However, during steep market downturns the correlations between equity REIT and other asset classes can be high.

Valuation

This last section was in previous years' required readings but not in this year's. It is presented here for reference purpose only.

There are three commonly used approaches to real estate market value:

The comparison sales approach uses as the basic input the sales prices of properties (benchmark value) that are similar to the subject property. The price must be adjusted to reflect its superiority or inferiority to comparable properties. This approach can give a good feel for the market.

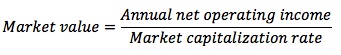

The income approach calculates a property's value as the present value of all its future income. It assumes that the annual net operating income (NOI) of a property can be maintained at a constant level forever (that is, NOI is a perpetuity). The most popular income approach is called direct capitalization:

Net operating income (NOI) equals the amount left after subtracting vacancy and collection losses and property operating expenses from an income property's gross potential rental income.

The market capitalization rate is obtained by looking at recent market sales figures to determine the rate of return required by investors.

The discounted cash flow approach is a variation of the income approach.

The cost approach is based on the idea that an investor should not pay more for a property than it would cost to rebuild it at today's prices. It generally works well for new or relatively new buildings. Most experts use it as a check against a price estimate.

Limitations:

- An appraisal of the land value is not always an easy task.

- The market value of an existing property could differ significantly from its construction cost.

An income-based or asset-based approach can be used to value a REIT.

User Contributed Comments 0

You need to log in first to add your comment.

I am happy to say that I passed! Your study notes certainly helped prepare me for what was the most difficult exam I had ever taken.

Andrea Schildbach

My Own Flashcard

No flashcard found. Add a private flashcard for the subject.

Add