- CFA Exams

- 2026 Level I

- Topic 6. Fixed Income

- Learning Module 19. Mortgage-Backed Security (MBS) Instrument and Market Features

- Subject 3. Residential Mortgage-Backed Securities

Seeing is believing!

Before you order, simply sign up for a free user account and in seconds you'll be experiencing the best in CFA exam preparation.

Subject 3. Residential Mortgage-Backed Securities PDF Download

A mortgage pass-through security is created when one or more mortgage holders form a collection (pool) of mortgages and sell shares or participation certificates in the pool.

Below is an illustration of how the pass-through process channels mortgage payments from homeowners to coupon payments to mortgage bond investors.

In the U.S., there are two sectors for securities backed by residential mortgages:

Agency pass-throughs have been pooled and securitized by one of the quasi-government mortgage agencies: Ginnie Mae, Fannie Mae and Freddie Mac. Note that only the Ginnie Mae securities are backed by the full faith and credit of the U.S. government.

Non-agency, or private-label mortgage-backed securities have been pooled and securitized by private banks or other corporations. Unlike agency, non-agency MBSs must rely on various types of credit enhancements to compensate for the lack of a government credit guarantee.

Measures of Prepayment Rate

The cash flow of a mortgage pass-through security depends on the cash flow of the underlying pool of mortgages and consist of monthly mortgage payments representing interest, the scheduled repayment of principal, and any prepayments, net of servicing and other fees.

Estimating the cash flow from a pass-through requires forecasting prepayments. One way of forecasting is to assume that some fraction of the remaining principal in the pool is prepaid each month for the remaining term of the mortgages. The prepayment rate assumed for a pool, called the conditional prepayment rate (CPR), is based on a pool's characteristics (including its historical prepayment experience) and the current and expected economic environment. The CPR is an annual prepayment rate. For example, if the CPR is 8%, we would expect that 8% of the remaining principal will be prepaid each year.

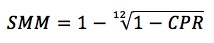

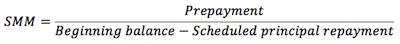

The single-monthly mortality rate (SMM) is the percentage of a pool's remaining principal that is expected to be prepaid each month. SMM is the CPR converted from an annual term to a monthly rate.

Example: if the CPR is 10%, the SMM = 1 - (1 - 0.1)1/12 = 0.87%

Now suppose that the principal balance in a pool is $10 million and $200k is scheduled to be repaid in a given month. The SMM is 0.87%. The forecasted prepayment amount for the month is 0.0087 x (10,000,000 - 200,000) = $85,260.

Note that scheduled principal repayments are neither included in the starting principal nor in the prepayment forecast. Prepayment does not include scheduled repayment.

The Public Securities Association Prepayment Benchmark is a schedule of prepayment speeds deemed to be "usual." Actual prepayment speeds are quoted relative to the PSA benchmark. If prepayments are following the PSA schedule, the speed is said to be 100% PSA. If prepayments are twice as fast as the PSA benchmark, the speed is said to be 200% PSA.

Example: if a seven-year old mortgage pool is experiencing a CPR of 9%, Its relative to PSA speed is quoted as 150 PSA. The CPR for a seven-year old pool should be 6% according to PSA; 9% is 50% greater than the 6% PSA. Thus, the current speed is 150 PSA.

The PSA benchmark is generally not a good forecast. It is simply a way of communicating how quickly principal on an underlying pool of mortgages is being prepaid. Further, since each measure can be translated into the other, there is no real advantage or disadvantage in using anyone of these measures on the exam or in practice. All three are communicating the same thing in different ways.

Weighted Average Life

A weighted average coupon (WAC) is the weighted average of the mortgage rates of the mortgages in a pool, where each mortgage's weight is proportional to that mortgage's outstanding principal balance relative to the total of all the principal balances.

Example: suppose there are three mortgages with respective balances of $100k, $200k, and $300k. The mortgage rates are 8%, 9%, and 10% respectively. The weights are 100/600, 200/600, and 300/600. The WAC is (1/6 x 8%) + (2/6 x 9%) + (3/6 x 10%) = 9 1/3%.

A weighted average maturity (WAM) is a weighted average of the remaining maturities of the mortgages in the pool, where each mortgage's weight is proportional to that mortgage's outstanding principal balance relative to the total of all the principal balances.

Example: suppose there are three mortgages with respective balances $100k, $200k, and $300k. The remaining maturities are 200 months, 250 months, and 300 months. The weights are 1/6, 2/6, and 3/6, respectively. The WAM is thus (1/6 x 200) + (2/6 x 250) + (3/6 x 300) = 266 2/3 months.

User Contributed Comments 11

| User | Comment |

|---|---|

| MasterD | 4 Factors: Prevailing mortgage rate, Characteristics of underlying mortgage loans, Seasonal factors, General economic activity |

| actiger | The numerator in the formula of the Macaulay duration has the present value factor at each timing of cash flow, but average life doesn't. |

| rhardin | Does anyone mind giving an example of average life and working it out mathematically? I'm not sure I completely understand the equation. Thanks! |

| Allen88 | Anyone understand why SMM isn't equal to 1-(1+CPR)^(1/12) rather than the equation given. |

| oregan | CPR = 1 - (1 - SMM)^12. Do the math. The notes is correct. |

| Allen88 | Yes oregan. I know how to rearrange the equation. I was asking for the intuition as to why it works. |

| KCRail | Hey, continuing with the rearranged equation, it's because the (1-SMM) is how much is remaining after the month (so SMM=1% = 0.99 remaining). The 2nd month, another 1% is paid back, so 0.99 * 0.99 remains. After twelve months, (1-SMM)^12, in this example 0.99^12 remains. So the amount paid back over the year is 1-remainder, or CPR=1-0.99^2 which is CPR=1-(1-SMM)^12. |

| business | interesting |

| pb09 | rhardin, luckily the LOS only states for us to explain its relavance not calculate it (one less formula to memorize!:) |

| soorajiyer | CPR = (1+SMM)^12 - 1. ==> Monthly compounded (1+SMM)^12 = (1+CPR) SMM = (1+CPR)^(1/12) - 1 Can somebody please guide me where am wrong? thanks! |

| soorajiyer | For the benefit of everybody here it is.. 1 - CPR = yearly survival rate 1 - SMM = monthly survival rate So 1 - CPR = (1 - SMM)^12 So SMM = 1 - (1 - CPR)^(1/12) Hope its clear for everybody now. |

I am using your study notes and I know of at least 5 other friends of mine who used it and passed the exam last Dec. Keep up your great work!

Barnes

My Own Flashcard

No flashcard found. Add a private flashcard for the subject.

Add